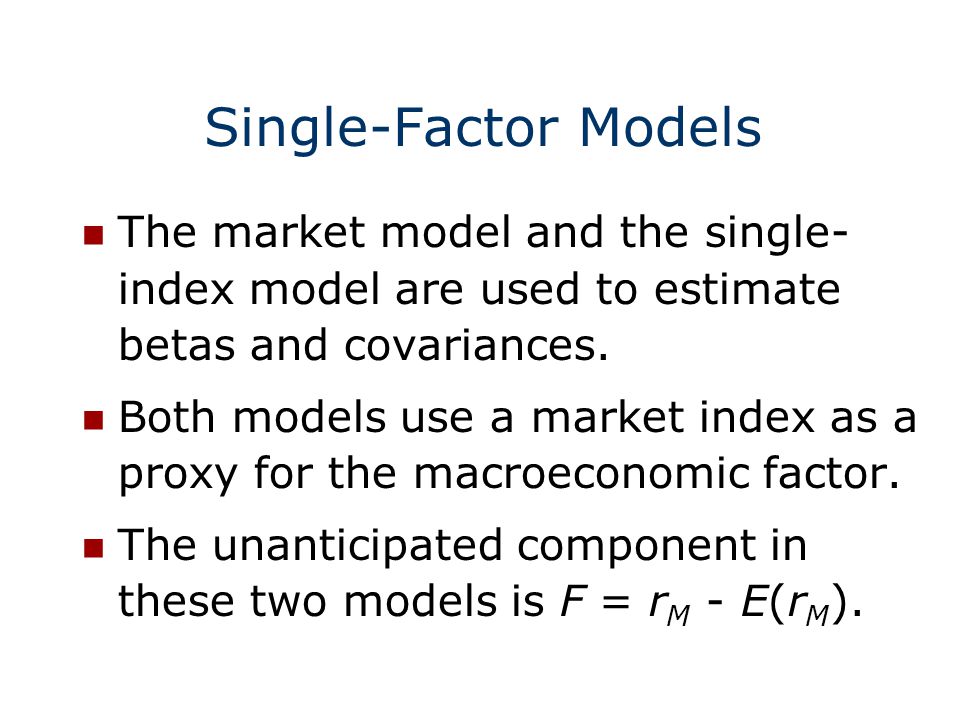

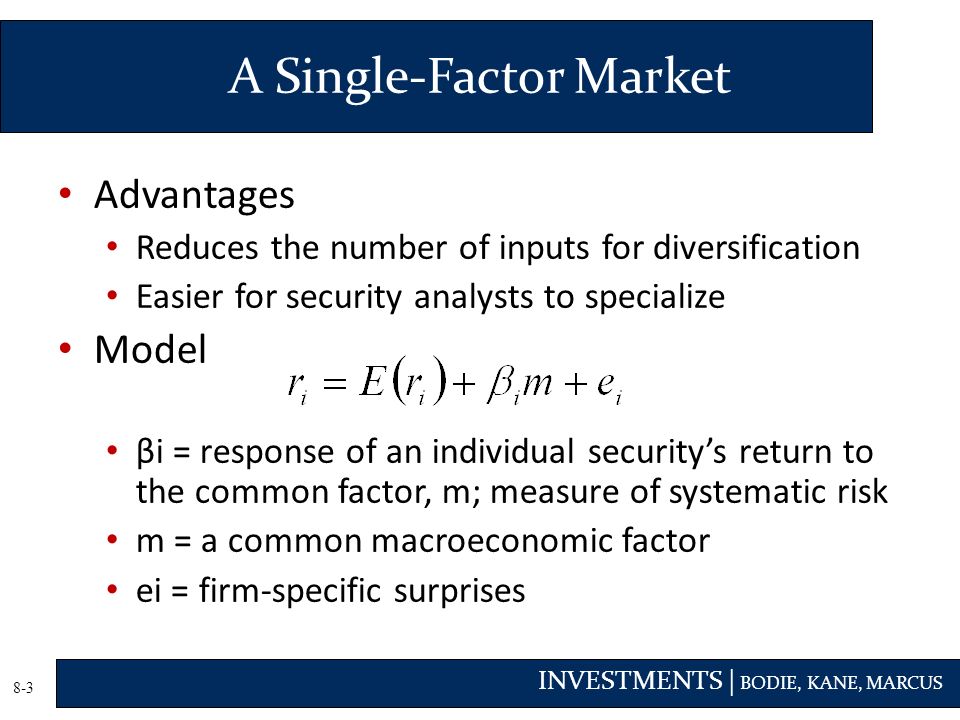

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

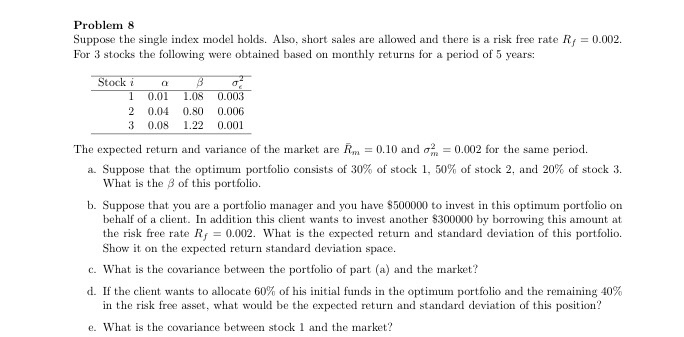

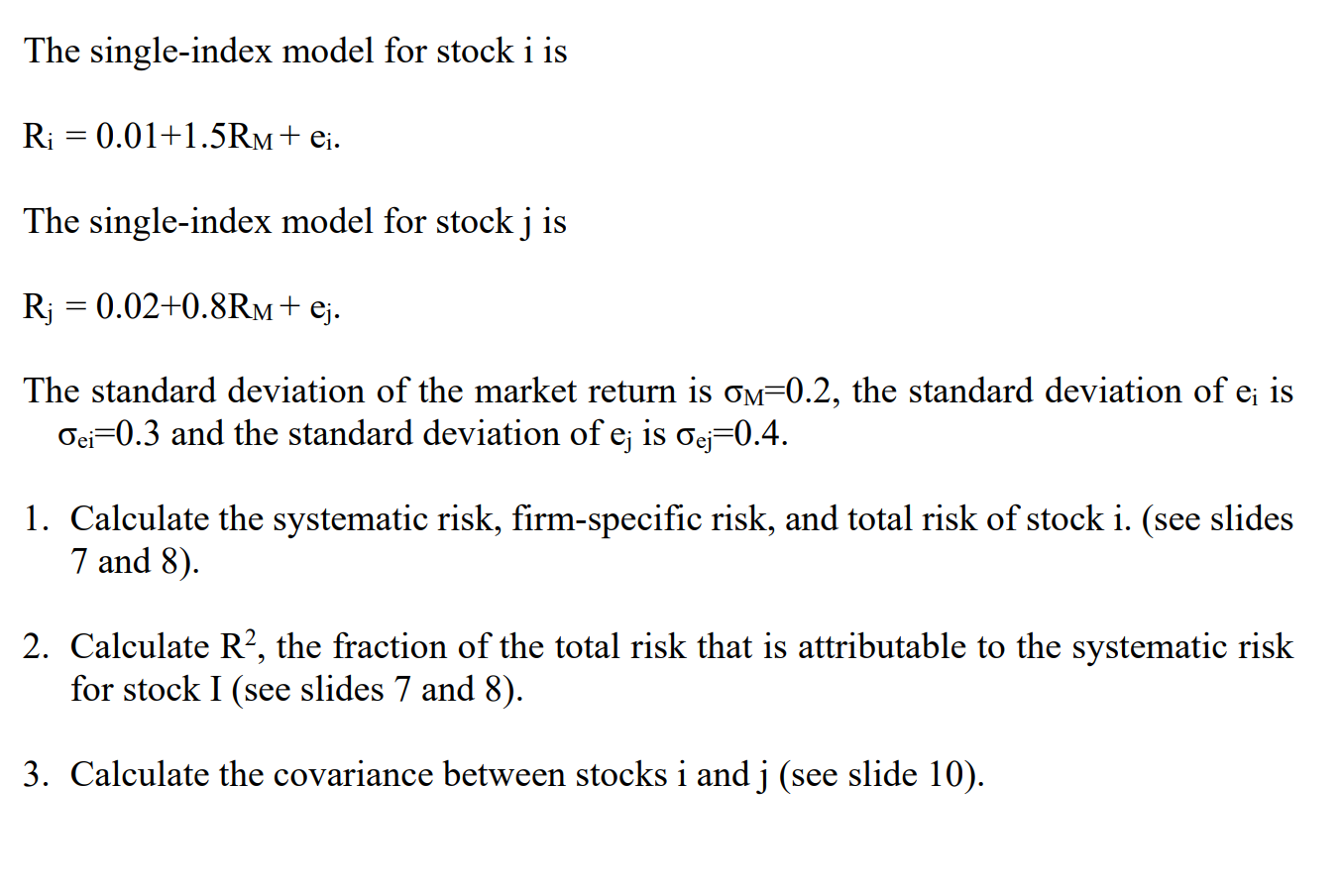

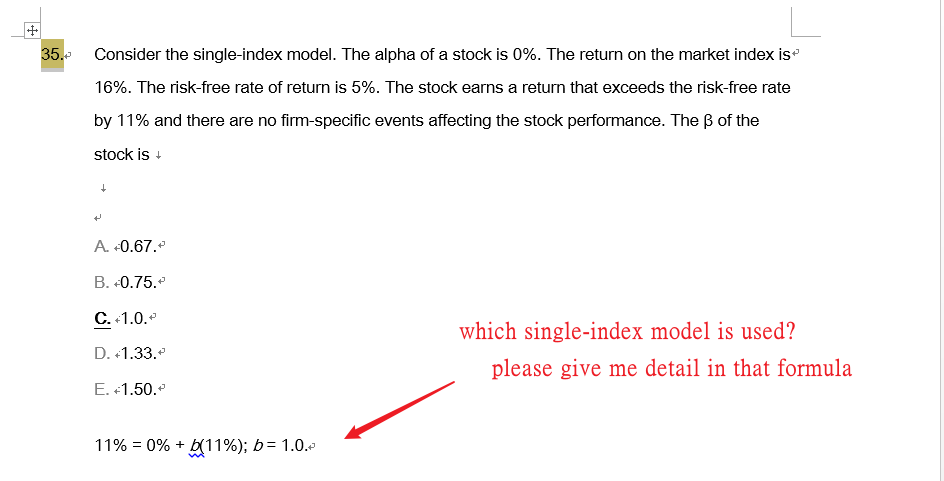

PDF) The Single Index Model Appendix 8-A Single and Multiple Index Models | Nick Di Giorgio - Academia.edu

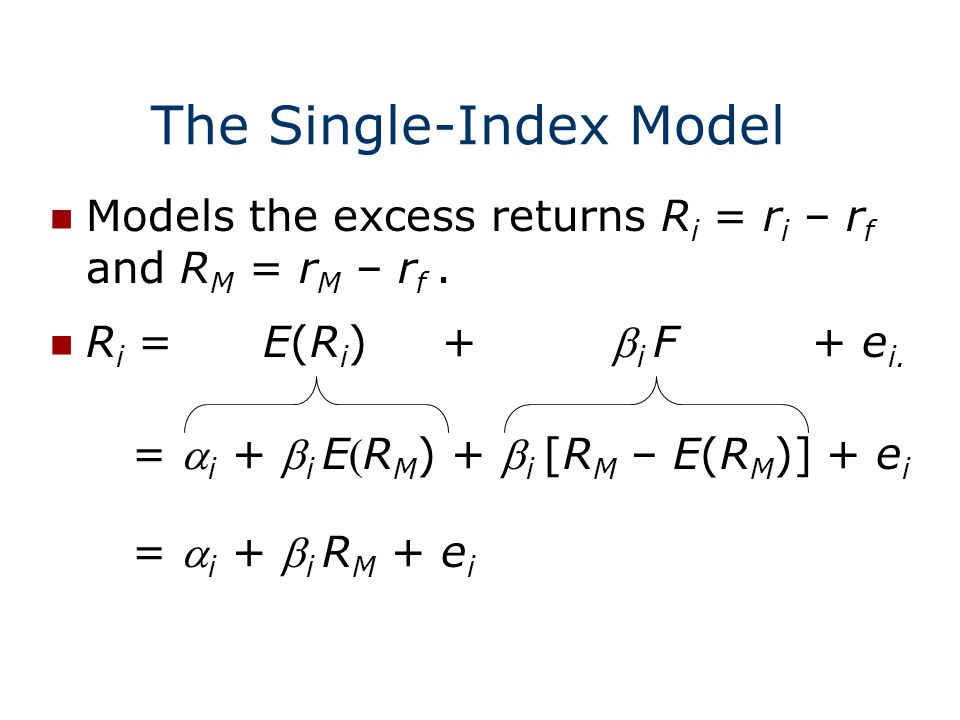

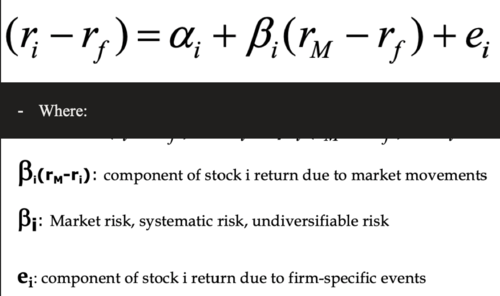

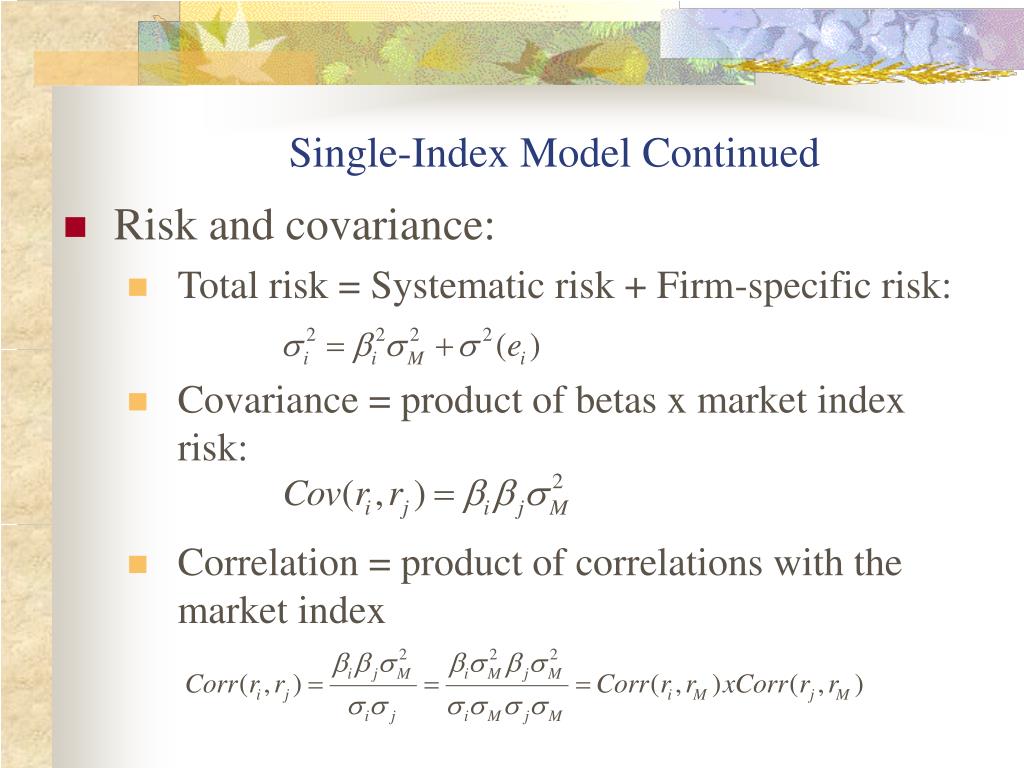

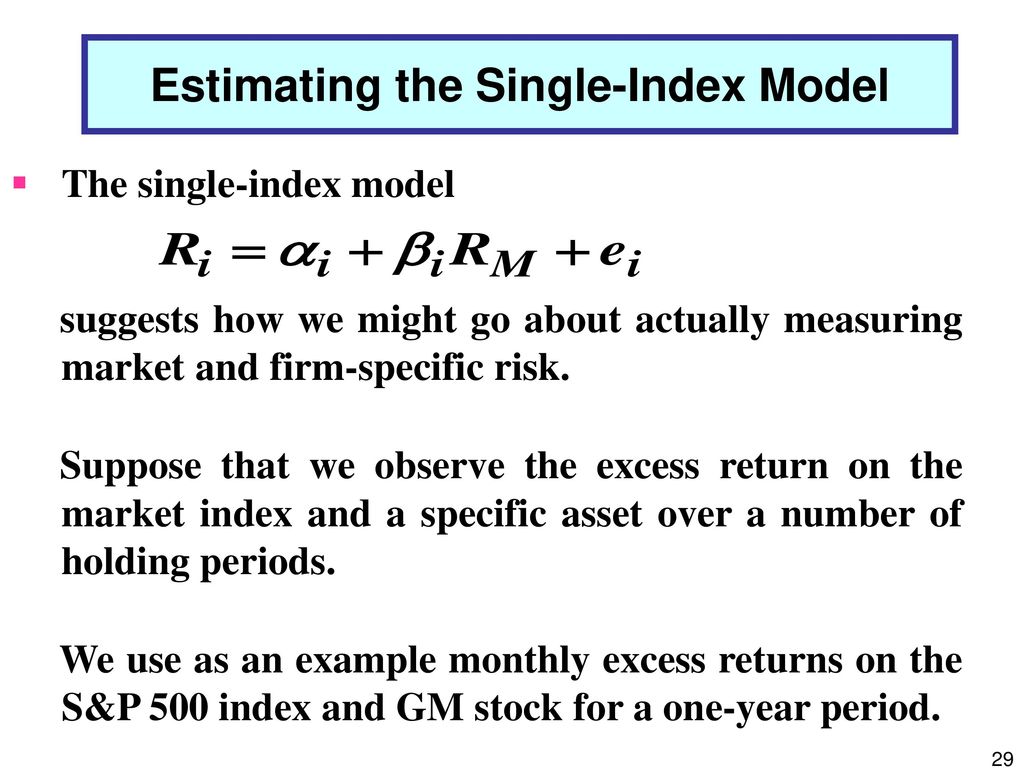

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download

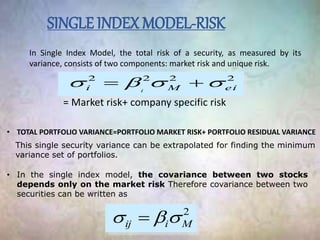

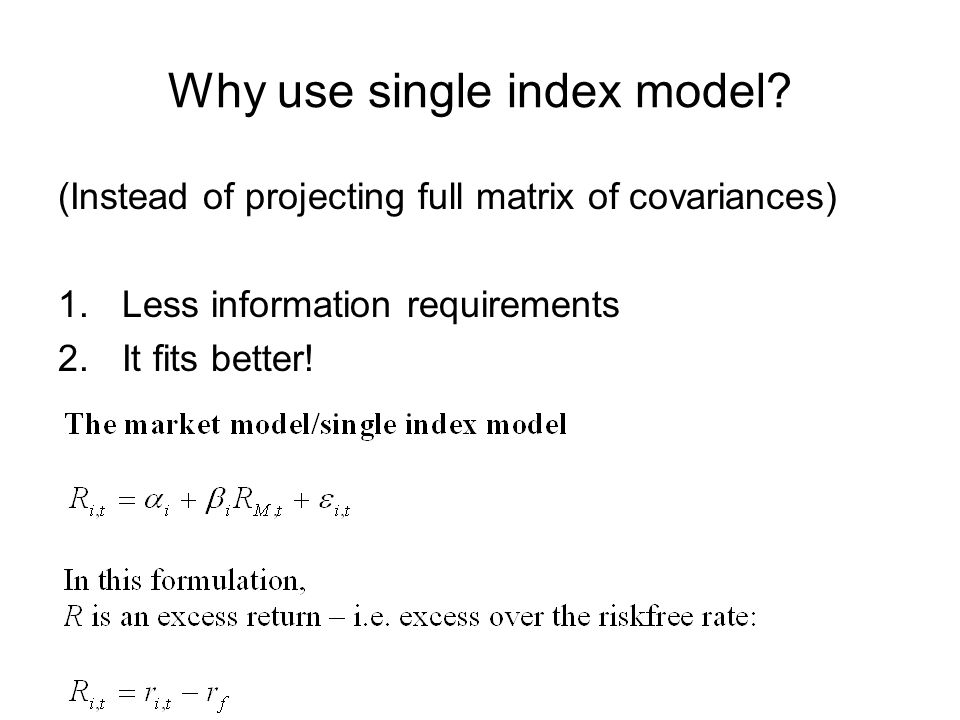

Why use single index model? (Instead of projecting full matrix of covariances) 1.Less information requirements 2.It fits better! - ppt download

7.1 A SINGLE-FACTOR SECURITY MARKET Input list (portfolio selection) ◦ N estimates of expected returns ◦ N estimates of variance ◦ n(n-1)/2 estimates. - ppt download